CARBON EXCHANGE

Markets where carbon credits are bought and sold are referred to as carbon markets. Companies or individuals can purchase carbon credits from companies that reduce or eliminate greenhouse gas emissions to offset the greenhouse gas emissions generated by their activities.

One of the tools used in the fight against climate change is carbon markets and carbon trading. Although it is criticized by some as “the wealthy can pollute,” it is a fact that it also contributes to the support of many environmental projects. Particularly for renewable energy projects, the revenue generated from emission savings has a positive impact on their balance sheets.

There are essentially two types of markets: mandatory and voluntary. Mandatory markets are established through regional, national, or international binding regulations. In voluntary markets, carbon credits are issued and traded at the national or international level.

The most important mandatory carbon market is the European Union’s Emissions Trading System (ETS). This system is based on the “Cap and Trade” principle. A cap is set for the parties within the system, determining how much emissions they can release. Polluters that exceed this limit must obtain allowances for the excess amount. One ton of carbon allowance grants permission for the emission of one ton of CO2.

Another significant market is the Clean Development Mechanism (CDM), established under the Kyoto Protocol. Within this framework, carbon credits from emission reduction projects in developing countries can be used to meet the carbon reduction targets of industrialized countries.

Although Turkey does not yet have a mandatory carbon market, efforts are ongoing under the Ministry of Climate Change. There are plans to establish a system by 2025, initially targeting enterprises with annual CO2 emissions exceeding 500,000 tons.

Another significant market is the Clean Development Mechanism (CDM), established under the Kyoto Protocol. Within this framework, carbon credits from emission reduction projects in developing countries can be used to meet the carbon reduction targets of industrialized countries.

Although Turkey does not yet have a mandatory carbon market, efforts are ongoing under the Ministry of Climate Change. There are plans to establish a system by 2025, initially targeting enterprises with annual CO2 emissions exceeding 500,000 tons.

In addition to mandatory carbon markets, there are markets where emission credits verified and validated according to standards set by independent organizations, such as Gold Standard and VCS, are traded. Transactions in these markets are often conducted through retail trading companies or brokers. There is significant demand for voluntary carbon credits within the framework of CORSIA.

CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation) is a market-based measure developed by the International Civil Aviation Organization (ICAO) based on its 2016 decision to cap international aviation emissions at 2020 levels. It will be implemented in three phases: the pilot phase from 2021 to 2023, the first phase from 2024 to 2026, and the second phase from 2027 to 2035. Participation is voluntary until 2027. The ICAO Council recognizes certificates issued under the following emission programs/standards:

– American Carbon Registry

– Architecture for REDD+ Transactions (ART)

– China GHG Voluntary Emission Reduction Program

– Clean Development Mechanism

– Climate Action Reserve

– Forest Carbon Partnership Facility (FCPF)

– Global Carbon Council (GCC)

– The Gold Standard

– Verified Carbon Standard

– American Carbon Registry

– Architecture for REDD+ Transactions (ART)

– China GHG Voluntary Emission Reduction Program

– Clean Development Mechanism

– Climate Action Reserve

– Forest Carbon Partnership Facility (FCPF)

– Global Carbon Council (GCC)

– The Gold Standard

– Verified Carbon Standard

Since there is no mandatory emissions market in our country, trading is conducted in voluntary markets. Based on a report prepared by a technical consultant on the emission savings of power plants, certificates are approved by accredited organizations in accordance with the standards of independent organizations such as Verra Verified Carbon Standard (VCS), Gold Standard, Global Carbon Council, International Carbon Registry, Climate Action Reserve, and American Carbon Registry.

The customers for certificates vary depending on the standards used. You can reach potential buyers through the carbon market section of our website.

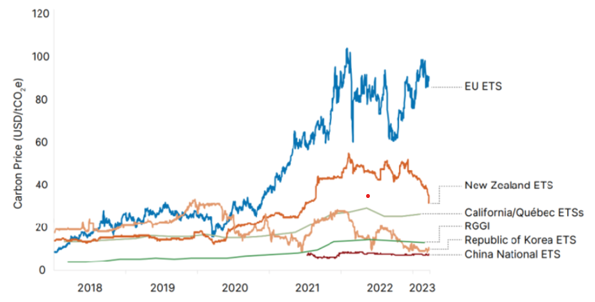

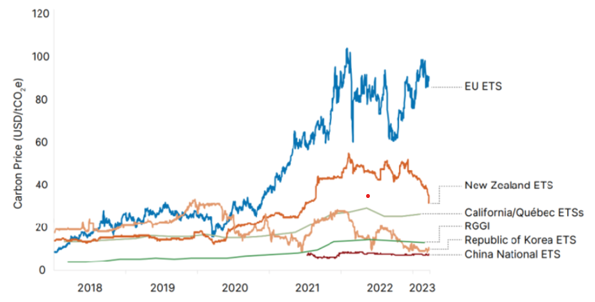

ETS prices are more transparent and are published on various portals. The highest ETS price so far was €97.5 per ton of CO2 equivalent in 2022. According to the World Bank’s 2023 report, the price trends in major markets can be seen in the Figure.

In general, the prices of certificates in voluntary markets are lower than those in mandatory markets.

In general, the prices of certificates in voluntary markets are lower than those in mandatory markets.

Generally, consultants have access to certificates through companies in their networks, but this may involve high commission fees. Instead, you can fill out the form on our website to access the certificates you need at more affordable costs.

The European Emissions Trading System (ETS) has been in place since 2005. Although there have been changes to address various issues over time, significant changes were made with the European Green Deal in 2019 and the Fit for 55 package in 2021, which outlines the implementation path for the Green Deal targets. These changes can be summarized as follows:

– Emission limits have been established for maritime transport. The sector’s greenhouse gas intensity is to be reduced by 2% by 2025 and by 80% by 2050.

– A new emissions trading system, called ETS 2, has been introduced for buildings, road transport, and additional sectors (mainly small industrial enterprises previously not covered by ETS). This system will be implemented in 2027.

– A Social Climate Fund with a budget of €86.7 billion has been created to support vulnerable groups in society from 2026 to 2032.

– Resources for the Innovation and Modernization Funds have been increased.

– Rules have been established for the removal of free allocations in aviation and certain industrial sectors.

– The Market Stability Reserve has been strengthened.

– Emission limits have been established for maritime transport. The sector’s greenhouse gas intensity is to be reduced by 2% by 2025 and by 80% by 2050.

– A new emissions trading system, called ETS 2, has been introduced for buildings, road transport, and additional sectors (mainly small industrial enterprises previously not covered by ETS). This system will be implemented in 2027.

– A Social Climate Fund with a budget of €86.7 billion has been created to support vulnerable groups in society from 2026 to 2032.

– Resources for the Innovation and Modernization Funds have been increased.

– Rules have been established for the removal of free allocations in aviation and certain industrial sectors.

– The Market Stability Reserve has been strengthened.

The Carbon Border Adjustment Mechanism (CBAM) is a mechanism designed to prevent carbon leakage into Europe. Under CBAM, the carbon allowances under the EU ETS will be completely phased out between 2026 and 2034. This mechanism aims to prevent products manufactured in countries with more lenient climate policies from replacing products made in compliance with stringent environmental regulations in the EU. A fair price will be set for emissions generated during the production of goods imported into the EU. To import goods into the EU, importers will either need to purchase Carbon Border Adjustment Certificates or provide proof that carbon pricing has already been paid in the exporting country.

CBAM will initially apply to the import of products listed in Annex 1, including cement, electricity, iron and steel, aluminum, fertilizers, and hydrogen. For products listed in Annex 2, only direct emissions will be considered.

There will be a transition period from October 1, 2023, to December 31, 2025, during which only reporting will be required. The system will become financially operational on January 1, 2026.

CBAM will initially apply to the import of products listed in Annex 1, including cement, electricity, iron and steel, aluminum, fertilizers, and hydrogen. For products listed in Annex 2, only direct emissions will be considered.

There will be a transition period from October 1, 2023, to December 31, 2025, during which only reporting will be required. The system will become financially operational on January 1, 2026.

From October 2023, sectors exporting to the European Union, including cement, electricity, iron and steel, aluminum, fertilizers, and hydrogen, will be required to calculate their embedded and direct emissions and report them via EU-based importers. Starting from January 1, 2026, they must either provide proof that a carbon price has been paid for the embedded or direct emissions produced during the manufacturing of these products.

According to the European Bank’s report on the potential impacts of CBAM on the Turkish economy, the sectors most affected by this regulation will be the iron and steel and cement industries.

According to the European Bank’s report on the potential impacts of CBAM on the Turkish economy, the sectors most affected by this regulation will be the iron and steel and cement industries.

FAQ- References

- https://climatepromise.undp.org/news-and-stories/what-are-carbon-markets-and-why-are-they-important

- https://www.aa.com.tr/tr/ekonomi/karbon-piyasasi-turkiyenin-yesil-donusum-surecinde-kilit-rol-oynayacak/3063390

- https://iklim.gov.tr/emisyon-ticaret-sistemi-ne-yonelik-egitim-programi-duzenlendi-haber-4235

- https://ticaret.gov.tr/data/65dc9d3113b8762768385d66/%C4%B0DB%20SKDM%20Sunum-%20ETS-SKDM%20%C4%B0li%C5%9Fkisi_23022024.pdf

- https://yesilbuyume.org/sinirda-karbon-duzenlemesi-mekanizmasi/

- https://yesilbuyume.org/uluslararasi-yenilenebilir-enerji-sertifikasi-i-recna-dair-merak-edilenler/

- https://www.ifac.org/knowledge-gateway/contributing-global-economy/discussion/understanding-voluntary-carbon-markets

- World Bank. 2023. State and Trends of Carbon Pricing, 2023. © http://hdl.handle.net/10986/39796 License: CC BY 3.0 IGO.

- https://transport.ec.europa.eu/transport-modes/maritime/decarbonising-maritime-transport-fueleu-maritime_en

- https://climate.ec.europa.eu/eu-action/eu-emissions-trading-system-eu-ets/what-eu-ets_en